MEASURING TV TODAY

Download MP3Evan Shapiro: [00:00:00] Can you see my screen?

Marion Ranchet: This is a sentence from Zoom. Okay. I can see your screen.

Evan Shapiro: That is the most, that's the most Zoom sentence ever. Can you see my screen?

Hi everyone. Welcome back to the Media Odyssey podcast. That is Marion Ranchet.

Marion Ranchet: And that is Evan Shapiro.

Evan Shapiro: And we have a pretty special weird episode this week. Marion, do you want to explain what we're doing here?

Marion Ranchet: Yeah, we're talking about what is actually very important for ad buyers in the U.S. in 2025.

And honestly, I think, very much globally that is cross platform measurements. EMarketer just released data. They surveyed ad buyers in the U. S. And what came as the main focus was cross platform measurement at 64%. [00:01:00]

Evan Shapiro: So we decided to do a special measurement episode just dedicated to, I think, one of our mutually favorite topics, which is measurement.

Yeah?

Marion Ranchet: Yeah. We don't want to talk, in the dark, so we want data to chew on. But as time goes, I don't know about you, but there's so much data, it very much fragmented. Nothing's perfect. We're going to talk about that and all of the different initiatives that are being put put to work.

Evan Shapiro: And what I love about this podcast is that we tackle these episodes. I do it from the U. S. perspective, although I'm currently in the U. K. right now, and you do it from the European perspective, but you're also in the U. K. right now because we're doing a live podcast in a couple of hours, which is very nerve wracking.

And but we each brought data from our own point of view. So let's run through the data. I'll do the U. S. You do Europe. And then we'll chat about what all this says about the current state of measurement cross platform and otherwise right now. Is that cool?

Marion Ranchet: Sounds good. Yeah. Let's go.

Evan Shapiro: Can you see my screen?

Marion Ranchet: This is a sentence [00:02:00] from Zoom. Okay. I can see your screen.

Evan Shapiro: That is the most, that is the most Zoom sentence ever. Can you see my screen?

Marion Ranchet: At least we're good on the mic, which for podcasters is quite important.

Evan Shapiro: You're muted. Right. You're muted and can you see my screen? Two most famous phrases from the pandemic.

So this just shows the various big data universes for the big measurement platforms in the U. S. Only one, Nielsen has one that is credited by the MRC. And I've talked at length online about what that process does to my head. But Nielsen has a big data universe of about 75 million homes. Comscore has 75 million homes. iSpot has 82 million homes. VideoAmp has 60 million homes.

So these are the various Big data solutions for television measurement and the advertiser perceptions did this survey and what they found was 85 percent of marketers who use alternative measurement or currency platforms see them as or more effective as Nielsen's and more than a third, 36 percent see those alternative measurement platforms more [00:03:00] effective than Nielsen's big data solutions.

When you look at Nielsen, they have a habit of putting out these various looks at the Gauge, which is by platform and then by channel. And you can see, one of the things I love about these charts on a regular basis is that they upend various mythologies about television. So when you look at the gauge, you can see 43 percent, according to Nielsen, of viewership in the U.S. comes from streaming. Around 24 percent from pay TV, around 22 and a half percent from broadcast.

However, when you combine broadcast and pay TV, which is how I think you should look at the cross platform measurement because most broadcast in the US comes through the pay TV ecosystem, you can see broadcast and pay TV often, if not always have a bigger share of television viewing in the US than streaming.

Streaming is huge and growing fast, and this was their biggest month in December. But it is still not equal to that of broadcast television. When you go to a different look of the Gauge this is by brand owners, total distribution on television across [00:04:00] all their various platforms. You can see Disney is the number one provider of content by those measurements.

And this includes ESPN and ABC and Disney Plus and Hulu.

Marion Ranchet: Hulu, yeah.

Evan Shapiro: You can see Paramount combined is in third place. NBC gets around 8 percent of total viewership, but YouTube by itself now measures at 11 percent of television viewing and Netflix measures at around 8.5 percent of television viewing in the U.S.

So this is all versions of their channels on television, but it is not cross platform measurement. When you look at total hours viewed in the U. S., ComScore, and this is brand new data that I'll be releasing soon. You can see that pay TV and streaming vie for number one for total usage on connected televisions.

Pay TV is actually the number one way that people consume content in the U.S., more than streaming. But streaming is catching up. When you look, however, ironically, the other way that I like, so this is total hours viewed, [00:05:00] pay TV over streaming, over broadcast. When you look at total ad viewership share, cable and broadcast combine for 86 percent of all ads seen on television versus just 14 percent of streaming.

Now, again, this is just connected televisions. It's not four screens in the home. But, considering how much usage streaming has, almost half of all television viewing, it only accounts for around 14 percent of total ad share on connected television. Now, another study that I just released this week with Barb shows this is four screen viewing and this is why I like Barb more than I like a lot of other measurements platforms out there.

They're giving us in home, four screen, total viewing time and you can see in the UK for people over the age of four, which is all television viewers, in the UK, BBC is still number one. YouTube is number two though, on four screens [00:06:00] higher than ITV, higher than Channel 4, higher than Sky. ITV is number three and Netflix is number four, and then the rest roll out.

When you look at the various demos, and again, this is four screens: laptops, phones, tablets, and televisions in the home, you can see how much more viewership for broadcast comes from older viewers. Over 35, the top three are BBC, ITV, Channel 4, and then, going down the list, Sky, Paramount. You know, Netflix comes in 7th place for viewers over 35 on four screens in the UK.

On the flip side of that, When you look at 16 to 34 year olds. YouTube is number one, Netflix is number two, TikTok is number three, BBC falls out of the top three and behind TikTok for four screens. And then for younger consumers, you can see YouTube is actually number one by a lot taking up almost 37 percent of total four screen time with Netflix half of that, or less than half, of that and BBC number three and then [00:07:00] TikTok from there.

What I love about this data is the look at four screen time in the home. This isn't on a bus, this isn't at the doctor's office, this isn't outside. This is in the home. And I love the way Barb cuts the data across four screens and across demographics.

So that is my data. What did you bring?

Marion Ranchet: Actually, very often I hear you complain about the data that you guys have in the U. S. And honestly, I'd give, anything to get the Gauge in Europe. Why? Because, as imperfect as it is, or maybe, depending on who you're asking. It is consistent data that you get, month in, month out.

The other thing is that these guys are making it widely available. It's not behind a paywall to, to get access to that data, which I love as well. Because if you look at, I'm thinking about the French market. On the French market for now, if you look at the French market, only [00:08:00] this year will we get across measurement methods across the universes, so to say, right? So what I love is that they're putting this together.

Evan Shapiro: So streaming platforms versus...

Marion Ranchet: Exactly, because what we're getting daily, weekly, very often, it's behind the paywall. So it's not, we don't have access to even have access to that data unless you're paying a subscription to get it.

And so what we know is how people watch TV in France. So the good thing is that we know it's, everyone, the entire population above four, it's all screened since last year. It's in and outside of the home. So on that side, I think we have the perfect tool and method, but of course, we're only talking about broadcast television and therefore we don't know what really happens on Netflix and the others, right?

So it's not to say that there's absolutely no data. But we don't have consistent, regular, easily accessible data like [00:09:00] you guys have. So what's going to be fascinating this year is, I don't know what the output will look like, but let's say it looks similar to what Barb does. I think it's going to be fascinating and we'll be seeing a lot of people cringing at, what the data will tell.

Because, so in December we, there was a massive debate because the MD of YouTube in France says YouTube is the number one TV channel in France. Honestly what's wrong with that statement is that, it's lumping everything and I'm sorry, even if it's video, it's different than the TV channel.

We, I think we need to compare apples to apples. Now there's no doubt that YouTube is huge. And the data she shared was that there's 44, no, 42 million monthly active users on the French market watching on average, 40, 41 minutes of YouTube every day. I think we'll see similar data

Evan Shapiro: On TV or total?

Marion Ranchet: As a whole.

Evan Shapiro: Okay.

Marion Ranchet: I think we'll see similar data to what you [00:10:00] have. What what I love about what these guys are doing is that they have a very much collegial approach. You'll have the broadcasters, you'll have the streamers you have the brands and agencies, right? If you go to the next slide, what, where are they going to go?

So you have the before, which is what I was mentioning. That was really the TV world. If you look at the cross video measure that they want to put in place, what's great is that they're doing two things, which I think is quite different from Barb. So we can go back to that a bit later.

There's going to be content measurements, right? So you will understand in a way the audience for all content from a single publisher. So I think that would be the distributor gauge from Nelson would be the right comparison. Then you'll see about a given environment, so that's the Gauge, so to say. Then you'll get a sense of, how content is performing, across different platforms, et cetera.

But what's interesting is that they're also building an app measurement tool. That's important because we don't only want to [00:11:00] know who's the biggest. We want to know who's making the most impact, who has the best attention, et cetera because. In this world that you showed about the UK, about Barb, if you look at this, you're thinking, Oh, I'm going to put all my money on YouTube, right?

The attention, the experience, the context matter, right? And so it's not because it's the biggest, this isn't necessarily where you should put all of your money. And I think that's, what's interesting here.

Evan Shapiro: Yeah. That's why I like about, that's what I love about Comscore, that report that I put out last fall, and we're going to put out a new one.

We see the total hours viewed, but then you look at the, where the ads are being viewed. And you can see there's just not that much inventory or audience on most of streaming. Even now, with all those new paid streaming subscribers to the ad tier, they're just not generating the same audience that broadcast and pay TV do on an ongoing basis.

And so what I love about this is it combines what Comscore [00:12:00] does with that ad view stuff and Nielsen does measure C7, C3. So they're showing you, the ad break viewership, but they're not showing the ad performance necessarily. And so I think what I love when you laid this out on the PowerPoint side is, Oh, this is interesting. They're measuring content performance and ad performance side by side.

Yeah, I agree. I think that's, well you had one more thing that you wanted to look at, which is the first slide, right?

Marion Ranchet: So that's where, if you look at the UK, this is where it gets tricky. Is that if you're not pushing a method where you do content measurement and advertising measurements, then you end up with this situation where, you know, honestly, the data from Barb, it's so extensive it's fascinating. And I think it's great that you're putting it out there for us.

Evan Shapiro: Thank you.

Marion Ranchet: But what's missing is the ad measurement piece. And therefore is ISBA, it's a trade organization, they represent brands and advertisers in the UK markets. They started...

Evan Shapiro: ISBA right?

Marion Ranchet: Yeah, exactly. And they've started working on this project, the Origin [00:13:00] Program. They've actually gone live, I think, in September with, as a beta, and so what's tricky with this is that, so the reason why they're doing it is, they want to be able to plan across all of the different, ecosystem. They want to be able to really understand the reach, the frequency, all of those things.

And they found that nothing was doing that for them. So they decided to do it. In a way that's fine, I love the initiative. The challenge is that they've decided not to work with Barb. And they've decided to build their own panel data with Kantar. And so we end up with potentially two currencies in the UK.

Evan Shapiro: Yeah. But are they different currencies? Is Barb used as a currency the same way that Nielsen is? I don't, yes, there's measurement and there is measurement around content. But for the reasons that you just said, and I think it does, I think that may be, and I have Justin Simpson from Barb on stage later today, so I can ask him this, but I don't think, I don't think [00:14:00] necessarily currency is the goal of Barb. They're not a real commercial industry. They're not a business the way Nielsen is. Which I actually appreciate. Yes, they work with Kantar for data, but they are, they're a jick. That is what they are.

Yeah. And everybody's in it. Even YouTube is in it. And that is what I think makes it effective. I don't know, I'll ask them if they have a goal for being a current team.

Marion Ranchet: Ask him. Yeah, he actually wrote an article about that topic. I think he's quite mad.

I think he's quite mad. Honestly, he said that they should be working together. And I think he's very much extending, I had to say, let's work together. Yeah, exactly. Instead of, doing things in silo because, so one of the challenge, and I think this is also what's, what we're going to be seeing everywhere, and you will see that in the U.S. is that all of these guys working together is one thing, then they need to agree on definition. That seems very limited, but at the end of the day, what is a view? What is attention? What's, how do you measure impact?

Evan Shapiro: What is important? What is the [00:15:00] currency? What are we measuring?

Yeah, so let's ask that. Let's let's ask that question. You have this example, which I think is a really good one. And then, let's zip back here. Barb is, this is pure viewership, right? And this is four screens. And I got a lot of grief about only focusing on four screens last time. So this report has television screen only as well, and it shows you the trends are just as troubling for broadcasters there.

But then, there's, here's total viewership for, from Comscore. Here's ad viewership from Comscore. Here's total viewership from Nielsen, just total over the top viewership. And then here's ad viewership from Comscore.

So let's debate this. What should we be measuring? Is it ad viewership? Is it the number of impressions that someone can reach? With, or unique viewers that they can reach with an ad or, is it something that I talk about all the time, which is outcomes? Shouldn't we just be measuring at the end of the day, how many cans of soda we sell and how many cars we sell?

Marion Ranchet: So actually that's what TV guides in Europe are saying. And [00:16:00] so again, going back to when YouTube France said we're the biggest channel. Of course, you had Mediamétrie, which is the equivalent of Barb and and Nelson come and say, actually, that's not true. And then bring the data to to back it up.

But you also had the SNPTV, which is representing advertisers, and they talked about the ROI of TV, how it was higher than on YouTube. These guys are releasing data on attention, and again, send that, the attention within the TV environment is, well the TV broadcast environment is higher than on YouTube and social.

I don't know if I will have an answer for that. I think that's absolutely part of the discussion that these guys need to have, right?

Evan Shapiro: Yeah what's fascinating is it plays a whole other game. YouTube, I don't think, really gives a shit about ratings or view ship or total you know, they care about number of hours viewed, and that's something that they brag about.

At the end of the day their data stack is so spectacular, they can give you a rate of [00:17:00] return on your spending, on the dollars that you've spent on ads. By the way, Meta can do this as well, Amazon can do this as well, in a way that today, the connected television cannot. And for all the big data, and Barb uses big data plus panel, Nielsen uses big data plus panel. It sounds like everybody's getting into that mix.

None of them can provide the kind of walled garden data of environment as the big walled gardens, the big digital players, and that, to me, we can play around with all these panels and other aspects and ACR data until television gets as good at measuring ad outcomes and ad actual reach even with half of digital media being fraud, potentially.

Because it is so outcome based and because the data is so good, there's a distinct advantage there, and that's been the larger point I've been making when I critique the data providers for the television ecosystem. That's my largest complaint, is you're still antiquated compared to Google, compared to Amazon, compared to [00:18:00] Meta.

Marion Ranchet: So that's the beauty of so to say, of walled gardens. They are their own thing and they can do whatever the hell they want. I'm not so keen.

Evan Shapiro: But doesn't that mean that television and the other media, it's incumbent upon them to collaborate. To your point from earlier, more data stacks can get as large and as powerful as the true competition, which is not each other, but the big digital players.

Marion Ranchet: Yeah, but we can't blame the fact that the reach of a walled garden like YouTube, it is what it is, right? And so the broadcasters, that's not where they should, to your point, compete. They need to work together to bring that critical mass. I absolutely absolutely agree. But it's easier to have one tech stack with so much reach.

It's easier to be so data savvy and so granular and et cetera. These guys are actually more, they're not the hub. They are fueling hubs and they are fueling hubs, [00:19:00] web, mobile, on CTV, with telcos, you name it, right? It's extremely fragmented, so we can't really blame them.

But I will say that where I think they will be happy to actually show and see the efforts, right? So a lot of the broadcasters across Europe have put a lot of work in building streaming vehicles exactly to that point and having that direct relationship, knowing more and then, bridging that TV data that they had from folks like Mediametri and Mediamat with what they see on the streaming side, they will be able to show their digital, their TV plus streaming universe, and we're going to have very different conversation.

But yeah, I mean it won't be fixed in a day for sure. And you can see...

Evan Shapiro: No, my hope is that we can get, continue to make progress. And I think, look Nielsen finally announcing their big pa big data plus panel and getting it accredited, it would be great to see the other players get their product accredited so that we can have more big data in the conversation. Barb has big data, it [00:20:00] sounds most of the solutions that you're looking at here in Europe are starting to integrate those elements, not just panels, into what they're doing.

But we can nerd out about this all the time. But.

Marion Ranchet: I have one question for you about having, multiple companies, measurement companies is that a good or a bad thing? Because honestly, so if all of this, those four companies you showed are accredited, my worry is, again, are they going to be applying the same definition?

Or are they always slightly, different, and we end up having four sets of data, and we just don't know which data to trust.

Evan Shapiro: Yeah, as much as that frustrates you, I think, ultimately, at the end of the day, and this is the point I was trying to make at the top it's, the measurement has to be between the buyer and the seller.

And the reason why MRC has merit in the U.S. is so that there's someone who can be a third party [00:21:00] accrediting that says these meet the standards of X, Y, and Z. The reason why I think Barb needs that distance from the marketplace here is for that same reason. Everybody agrees that they're the arbiter of how to shift this.

And they all have input as to how that organization works. It sounds like. All these other new opportunities are also going to be driven by collective at the end of the day. And so I think at the end of the day the key relationship on measurement is between the platform who is providing the impressions and the buyer of that, of those impressions.

And I think everybody should have choice around how the measurement works. Yeah, it's going to be hard to do pure apples to apples as much as that frustrates you and I, that is not, I think, how the world will work. People will measure their own campaigns on Google. I think TV should be considered as an interface as large as Google, as large as Amazon, because ultimately, right now, Meta will [00:22:00] sell more advertising this year than all of television.

And so television needs to act as a platform at the scale of these larger social media platforms if they truly want to compete on the quality of data and in the revenue generated. I think they're really going to have to be comfortable collaborating in that way. So I do think, to answer the question, I think we're going to have multiple different versions of it and that's, we're going to have to be comfortable with that.

Marion Ranchet: Yeah. So a healthy competition, pushing people to do better, innovate. In Europe, what I'm hoping is that at least we have, one or two per market. But I would love to see the region bringing, one. So actually Mediamétrie with, other national companies in other European market, but on not all in all other markets have built some sort of a consortium or just just a consortium to do something at scale because you have the [00:23:00] biggest markets.

So I would say that, if you have three, four companies doing this, that's great. And then you get this big market, you get data on this one big market. The concern I have, where I don't necessarily want to have 20 different people at this is that, there's so many different markets in the region already.

There's a level of fragmentation where I don't know if having multiple companies in each market is a good thing.

Evan Shapiro: That is the other, that is the other thing. No market is as large a television market outside of, let's say, China, India, or Russia as the U. S. And to truly cover it, I think you're ultimately going to need more than one currency.

And, by the way, especially when that currency tends to be very dated. And that is the other thing to remember here, is that one of the big needs for multiple currencies in the U.S. is there has been one player monopolizing that market for so long. Nimble is not what I would call them, but we do have to end there.

This has been a great episode I knew we would get a lot out of it. [00:24:00] Thank you for entertaining me and allowing us to bring PowerPoint slides to the podcast.

Marion Ranchet: No, that was awesome. Thank you so much. And yeah, we'll do some more, some more to come.

Evan Shapiro: Cool. You can check us out on Substack, mine is Media War and Peace, yours is Streaming Made Easy.

This has been another great episode of the Media Odyssey podcast. Thanks everybody. See you soon.

Marion Ranchet: Thanks everyone.

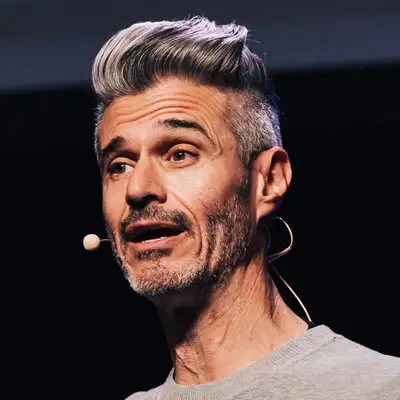

Creators and Guests